Taxable Ssi Income Worksheet

Also enter this amount on Form 1040 line 5a. Supplemental Security Income benefits are considered to be assistance and that means they arent taxable.

Savvy Senior Is Social Security Income Taxable

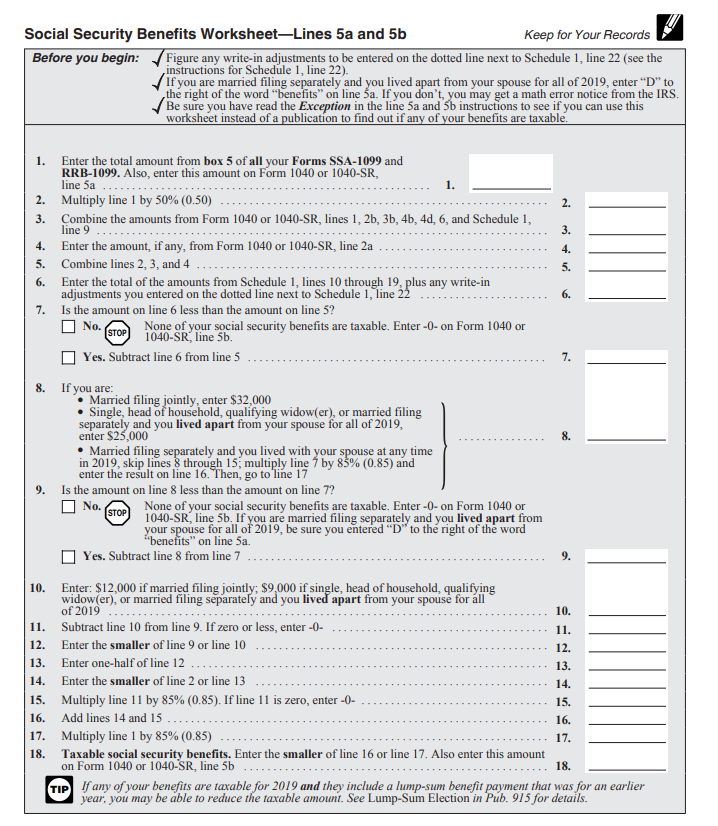

Multiply line 1 by 50 050.

Taxable ssi income worksheet. If an employee elects to defer income inclusion under the provision the income must be included in the employees income for the year that includes the earliest of 1 the first date the qualified stock becomes transferable 2 the date the employee first becomes an excluded employee as excluded from qualified employee 3 the first date on which any stock of the employer becomes readily tradable on an. Tax Return for Seniors and filling in the appropriate fields. The worksheet provided can be used to determine the exact amount.

Do not use this worksheet if any of the following apply. Social Security worksheet for Form 1040. Social Security Benefits Worksheet 2019 Caution.

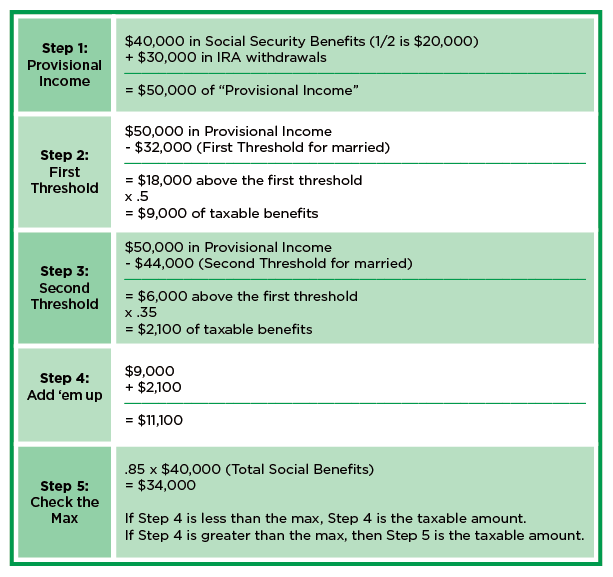

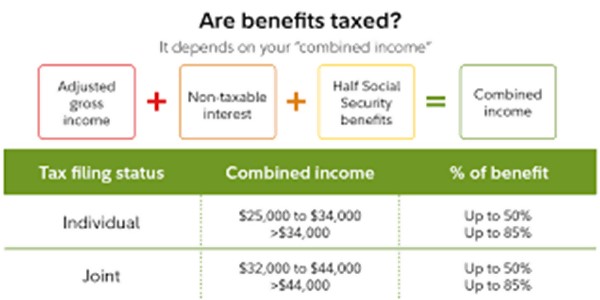

Multiplies line a by line bThe result is the monthly 2020 SSI income. Other income includes pensions wages interest dividends and capital gains. The taxable portion can range from 50 to 85 percent of your benefits.

However the IRS differentiates between Social Security retirement benefits and SSI paymentsSSI payments are not taxable but benefits may be. Social Security Taxable Benets Worksheet 2020 This document is locked as it has been sent for signing. Social Security Supplemental Security Income SSI recipients receive a cost of living increase of 13 for 2021.

Complete this worksheet to see if any of your social security andor SSI supplemental security income benefits may be taxable. Information about Notice 703 Read This To See If Your Social Security Benefits May Be Taxable including recent updates related forms and instructions on how to file. To view the Social Security Benefits Worksheet.

There are two calculations to determine the taxable Social Security. If your social security benefits are taxable you must report them to IRS by filing appropriate tax return-Form 1040 or the Form 1040-SR US. Worksheet instead of a publication to find out if any of your benefits are taxable.

Method 1 85 of the SS benefit maximum taxation. The file is in Adobe portable document format PDF which requires the use of Adobe Acrobat Reader. Like welfare benefits they dont have to be reported on a tax return.

You will recieve an email notification when the document has been completed by all parties. Using the 2021 SSI monthly benefit you can compute the monthly benefit received in 2020. For precise computation of taxable amount out of social security benefit use Worksheet 1 of Pub 915 Should you file tax return if social security taxable.

To find out if their benefits are taxable taxpayers should. Here are some examples of social security income and how much is taxable and how much is not. 1 If the taxpayer made a 2019 traditional IRA contribution and was covered or spouse was covered by a qualified retirement plan see IRA Deduction and Taxable Social Security on Page 14-6.

Box 5 of all your Forms SSA-1099 and Forms RRB-1099. Complete the income section for each household member. If there are more than two additional.

Combine the amounts from Form 1040 lines 1 2b 3b 4b. Ad The most comprehensive library of free printable worksheets digital games for kids. Cost of living adjustment COLA factor Energy Assistance Program The top part of this worksheet is for Social Security income and the bottom part is for determining SSI.

The top part of this worksheet is for Social Security income and the bottom part is for determining SSI income. This document has been signed by all parties. SCRIEDRIE Household Income Worksheet How to figure your household income Use the attached worksheet as a tool to determine your total annual household income for the calendar year immediately preceding the date you are filing this application.

Ad The most comprehensive library of free printable worksheets digital games for kids. Step 1 Enter the monthly amount of social security income received as supported on the social security award letter Section 13. As your gross income increases a higher percentage of your Social Security benefits become taxable up to a maximum of 85 of your total benefitsThe TaxAct program will automatically calculate the taxable amount of your Social Security income if any.

Social Security worksheet for Form 1040A. The non-taxable portion of income will be grossed up by 25 which will then be added back to the total income of the source generating the non-taxable income. You have successfully completed this document.

Enter the total amount from. Social Security Calculation Worksheet c. Social Security Calculation Worksheet.

Get thousands of teacher-crafted activities that sync up with the school year. The portion of benefits that are taxable depends on the taxpayers income and filing status. Get thousands of teacher-crafted activities that sync up with the school year.

Other parties need to complete fields in the document. Compute them both and use the smaller of the two. Take one half of the Social Security money they collected during the year and add it to their other income.

The taxable amount determined by the projection displays on the Social Security Worksheet report D16 then carried to the Taxable Income Analysis column 6 report D7. Non-taxable Income To be grossed up Definition.

Form 1040 2017 U S Income Tax Return

12 Irs Non Stimulus Tax Rules You Ll Need This Year Tax Rules Irs Tax Questions

Ssdi Federal Income Tax Nosscr

Social Security Benefit Calculation Spreadsheet In 2021 Social Security Benefits Social Security Social Security Disability

F709 Generic3 Lettering Worksheet Template Profit And Loss Statement

Publication 590 A 2018 Contributions To Individual Retirement Arrangements Iras Internal Revenue Servic Social Security Benefits Irs Tax Forms Tax Forms

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Taxable Social Security Calculator

Social Security Benefits Tax Calculator

Are Your Social Security Benefits Taxable Alloy Wealth Management

Income Tax On Social Security Benefits Back Alley Taxes

1040 Lump Sum Social Security Distributions

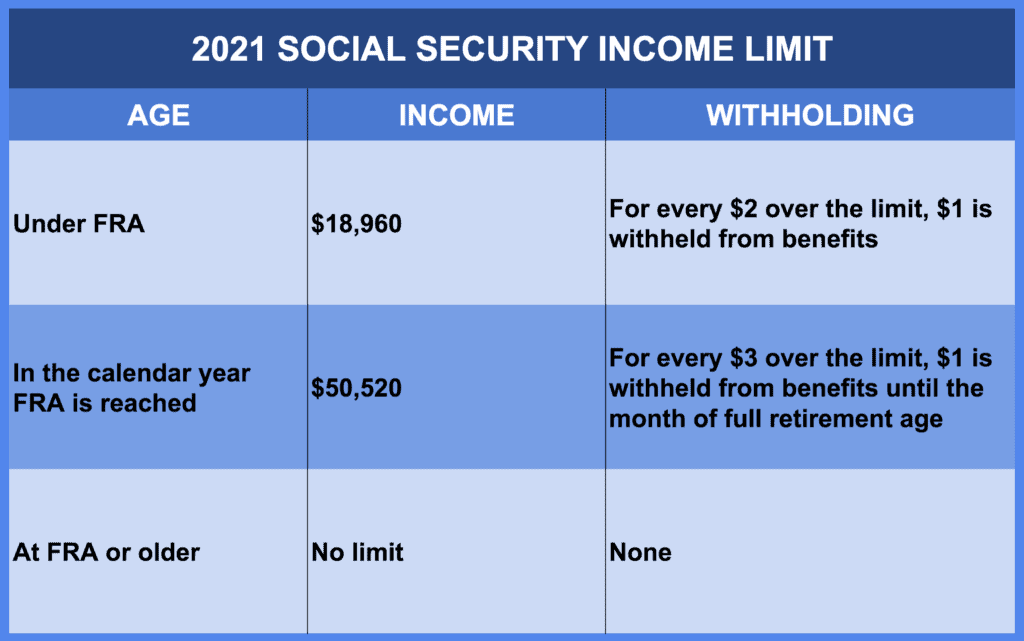

Social Security Income Limit 2021 Social Security Intelligence

Form 1040 Line 6 Social Security Benefits The Law Offices Of O Connor Lyon

Form 1040 Line 6 Social Security Benefits The Law Offices Of O Connor Lyon

Learn How To Calculate A Breakeven Point With This Helpful Formula Simple Budget Budgeting Money Homeowner Taxes

28 Publication 575 Pension And Annuity Income Worksheet Lean Six Sigma Business Template Personal Savings

A Closer Look At Social Security Taxation Jim Saulnier Cfp Jim Saulnier Cfp